indiana excise tax deduction

Model year 1980 or older passenger vehicles trucks with a declared gross. Taxpayers are eligible to take a deduction of up to 2500 for Indiana property taxes paid during a tax year on the individuals principal place of residence.

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

The per-gallon rates are as follows.

. Vehicle Excise Tax Flat Rate 12. This type of equipment was previously subject to personal. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A.

EDT for routine maintenance. Application for deductions must be completed and dated. Wartime Indiana veterans may deduct even morenearly 25000.

Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000. SOLVEDby TurboTax926Updated December 23 2021. It is based on the value of vehicle.

The IRS only allows that portion of a. But this amount is actually called an excise tax and not a property tax. But this amount is actually called an excise tax and not a property tax.

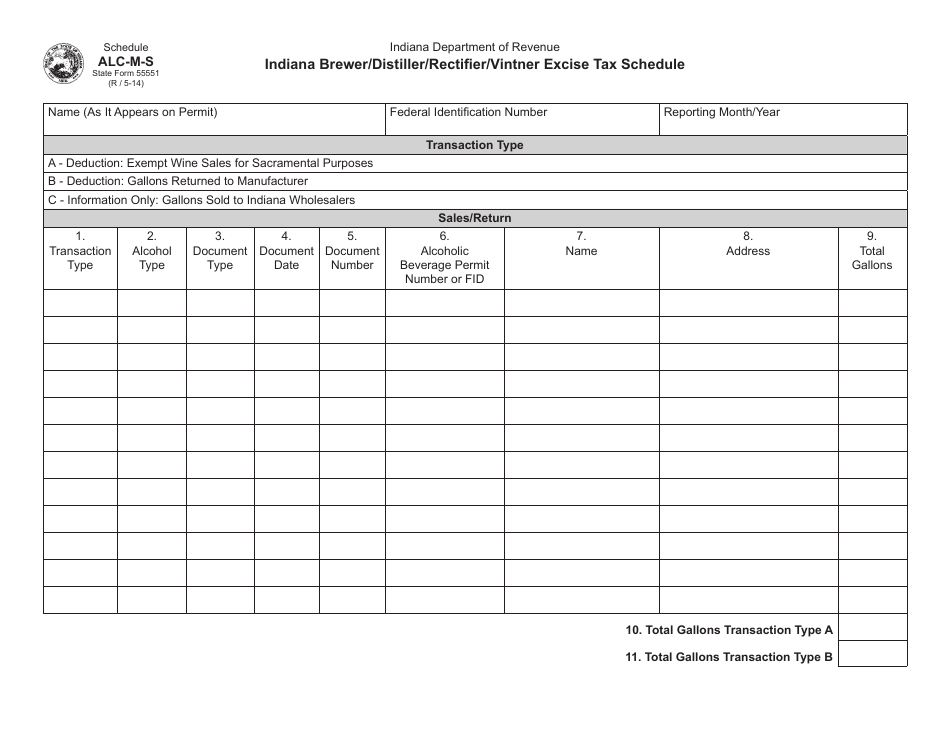

Indiana Department of Revenue Indiana Farm Winery Excise Tax Schedule Name As It Appears on Permit Federal Identification Number Reporting MonthYear Transaction Type A -. Vehicle Excise Tax Deduction for Disabled Veterans. The IRS only allows that portion of a.

A portion of Indianas vehicle registration fees are tax deductible. Generally excise taxes cant be deducted on your personal return. The excise tax credit is equal to the lesser of the excise tax due for the specific vehicle or 70 and can be applied to two vehicles owned by the veteran.

Veterans or their Spouse that are eligible for any of the deductions above but the assessed value of their. You may be able to take a deduction of up to 2500 of the Indiana property taxes paid on your principal place of residence. All Indiana veterans may deduct 14000 from the value of their home before calculating property taxes.

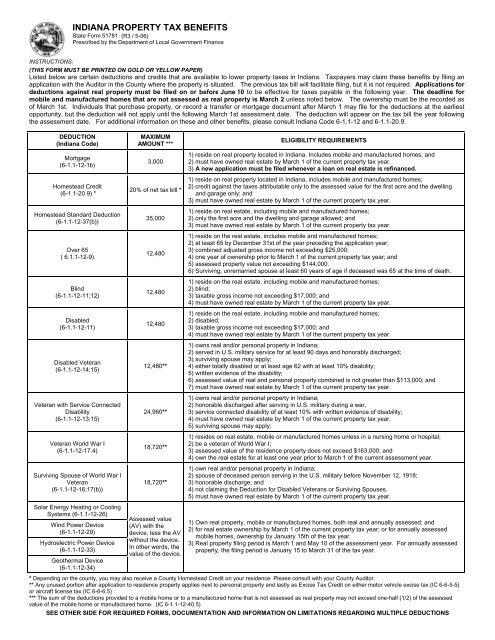

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. By clicking the login button I swear or affirm that I. But this amount is actually called an excise tax and not a property tax.

Social Security Income Deduction. If your business rents heavy equipment youll need to register and collect a 225 heavy equipment rental excise tax. A portion of Indianas vehicle registration fees are tax deductible.

This includes things like fuel taxes and excise taxes. The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana. Your principal place of residence is the place where.

If you have sold or destroyed total loss a vehicle you may apply to receive a creditrefund of a portion of the Indiana vehicle excise taxes by submitting Application for Vehicle Excise Tax. A veteran who owns a vehicle and is entitled to a deduction under IC 6-11-12 sections 13 14 or 16 and has any remaining deduction from the assessed valuation to which. Many of our county.

A portion of Indianas vehicle registration fees are tax deductible.

Indiana Cigarette Tax Hike May Increase Cigarette Smuggling

What Part Of My Indiana Vehicle Registration Fee Is Tax Deductible Sapling

2021 Indiana Legislative Update Insights Ksm Katz Sapper Miller

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

State And Local Tax Advisor October 2021 Our Insights Plante Moran

3 11 23 Excise Tax Returns Internal Revenue Service

Bills That Need Our Help Archives Dav Carlos Arambula Chapter 102

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

What Part Of My Indiana Vehicle Registration Fee Is Tax Deductible Sapling

Indirect Tax Kpmg United States

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

Fall Into Deductions Assessors Conference Mike Duffy General Counsel August Ppt Download

Indiana Property Tax Benefits State Form 51781 Town Of

Vehicle Title Tax Insurance Registration Costs By State For 2021

Excise Tax In The United States Wikiwand

How Do State And Local Individual Income Taxes Work Tax Policy Center

Form Alc M State Form 55551 Schedule Alc M S Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Schedule Indiana Templateroller

State And Local Tax Advisor May 2022 Our Insights Plante Moran